If you’re involved in a serious car accident and you or a loved one are seriously injured, it can be a major disruption to your life, your income, and your daily state of mind.

Unfortunately, in many serious auto accident cases the situation is made worse by insurance companies that refuse to pay what they should when your life is turned upside-down.

At Zarzaur Law, our Pensacola car accident lawyers fight the insurance companies and get justice for our clients. Our clients have been awarded record-setting verdicts in both Escambia and Santa Rosa Counties.

Let us help you get the compensation you deserve.

Joe Zarzaur is Board Certified as a Civil Trial Lawyer by the Florida Bar and is AV PREEMINENT Rated, the highest rating by Martindale-Hubbell.

MOST FREQUENTLY ASKED FLORIDA CAR WRECK QUESTIONS AND ANSWERS

1. I was in a car accident in Florida and I hear it’s a no-fault state, what does that mean?

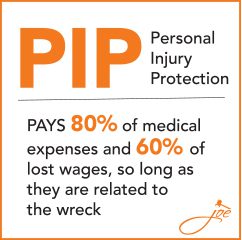

FLORIDA is one of the states that has a different system when it comes to car insurance. The car insurance law in Florida requires  that everyone purchase “no-fault” coverage (a.k.a. personal injury protection or “PIP” coverage). This coverage is generally a minimum of $10,000 and provides compensation to drivers in an accident, regardless of who was at fault in causing the collision. The PIP COVERAGE PAYS 80% of medical expenses and 60% of lost wages, so long as they are related to the wreck. What’s even more surprising is that your OWN PIP coverage pays for your medical and lost wages even if the other party is at fault for the wreck. Keep in mind, this only applies to the first $10,000 in bills and wages. Once your PIP coverage has paid the maximum amount ($10,000), the focus is then on the at-fault driver to make sure that any other medical expenses are covered. This is where the Pensacola car accident attorneys at Zarzaur Law, P.A. can assist in recovery for your injury case.

that everyone purchase “no-fault” coverage (a.k.a. personal injury protection or “PIP” coverage). This coverage is generally a minimum of $10,000 and provides compensation to drivers in an accident, regardless of who was at fault in causing the collision. The PIP COVERAGE PAYS 80% of medical expenses and 60% of lost wages, so long as they are related to the wreck. What’s even more surprising is that your OWN PIP coverage pays for your medical and lost wages even if the other party is at fault for the wreck. Keep in mind, this only applies to the first $10,000 in bills and wages. Once your PIP coverage has paid the maximum amount ($10,000), the focus is then on the at-fault driver to make sure that any other medical expenses are covered. This is where the Pensacola car accident attorneys at Zarzaur Law, P.A. can assist in recovery for your injury case.

2. The at-fault driver’s insurance company appears to be dragging their feet on accepting responsibility for this wreck, even though it was clear at the scene that they got a ticket for causing the wreck.

First, it’s important to understand that contrary to their feel-good TV advertisements, insurance companies are not in the business of making wrongs, right. Insurance companies are in the business of making money and will do so at all costs.

The typical process for an insurance company following a car wreck includes:

The typical process for an insurance company following a car wreck includes:

a. The at-fault driver’s insurance company doing their own investigation after a wreck regardless of what the investigating Trooper concludes at the scene, and if their insured driver received a citation for the wreck.

b. The wreck report is usually not available until a few days after the wreck. The document provided at the scene of the accident is not the wreck report. The wreck report will be titled the “Long Form” or “Short Form” Florida Accident Report and will be several pages with a diagram on the last page depicting the position of the cars at the time of the impact. The abbreviated document provided by the Trooper at the scene of the wreck is called a Driver’s Exchange of Information, and only has the identities of the persons involved in the wreck and their respective contact information.

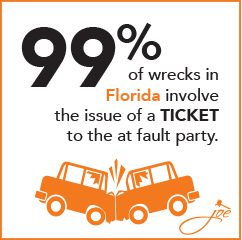

c. 99% of wrecks in Florida involve the issue of a ticket to the at-fault party. HOWEVER, THIS DOES NOT MEAN THAT THE AT-FAULT DRIVER’S INSURANCE WILL AUTOMATICALLY ACCEPT RESPONSIBILITY. The at-fault driver’s insurance company will still conduct a full investigation which usually involves taking a recorded statement from their driver and anyone in the driver’s car. THEY MAY ALSO TRY TO GET YOU TO GIVE A STATEMENT AND YOU SHOULD NOT SINCE IT IS NOT VITAL TO THEIR INVESTIGATION AND WILL LIKELY ELICIT SOMETHING THAT COULD BE DETRIMENTAL TO YOUR INJURY CASE.

d. The at-fault driver’s insurance company investigation takes about 7 to 10 days following the wreck and they like to treat you like they have all the time in the world. They know that the more desperate they make you feel the more likely you will just take what they offer you and not hire a lawyer to help you.

To speed up the process you can do a couple of things:

1. Hire a lawyer for your injury case. This important step usually makes the insurance company stop playing games, even with the car (property damage) issues.

2. File a claim through your own car insurance company for your losses. Have your car insurance company pay for your car, they will then get reimbursed by the at-fault driver’s insurance company, once they have completed their investigation. This second option assumes you have purchased full coverage for your insurance (in this context collision coverage). If you have full coverage then your insurance company can pay for your vehicle repairs immediately and then they will worry about the at-fault driver’s insurance company reimbursing them. This is the quickest and smartest route to take if you have full coverage.

If you don’t have full coverage, you will have to wait on the at-fault driver’s insurance company to finish their investigation.

3. What if the at-fault driver is uninsured or underinsured?

Generally, in a no-fault state like Florida, the insurance companies of both parties are responsible for the damages of their covered party. As already explained, Florida requires vehicle owners to have personal injury protection (PIP) and property damage liability (PDL) to cover damages resulting from accidents. While each party’s insurance company covers a percentage of all necessary and reasonable medical expenses, any excess is covered by the at-fault driver’s insurance company.

Generally, in a no-fault state like Florida, the insurance companies of both parties are responsible for the damages of their covered party. As already explained, Florida requires vehicle owners to have personal injury protection (PIP) and property damage liability (PDL) to cover damages resulting from accidents. While each party’s insurance company covers a percentage of all necessary and reasonable medical expenses, any excess is covered by the at-fault driver’s insurance company.

But what if the at-fault driver has no insurance or is underinsured?

Although Florida has stiff penalties for motorists who fail to carry the required insurance coverage, those penalties have not deterred a significant number of motorists who are uninsured. Uninsured motorists can have their driving privileges and vehicle registration suspended for up to three years. They may also be required to pay a $300 fee for the reinstatement of their driving license and vehicle registration. According to the Insurance Information Institute, Florida is among the top ten states with the highest percentage of uninsured motorists, with approximately 20 percent of motorists uninsured. This could be a problem for you if you are in a car accident with an uninsured or underinsured motorist who is the at-fault driver in your case.

If you are in an accident with an uninsured or underinsured driver, you may feel like you are stuck bearing the brunt of the financial consequences of the accident. But you have options.

If you are suffering from extensive injuries and are facing huge medical bills, it is worth it to seek the counsel of an experienced car accident attorney to understand your options and help you recover money from them.

Your attorney will investigate the defendant’s financial position and determine the best strategy for covering your damages. You may be able to seek compensation from your insurance company, or pursue an action against the uninsured driver. You may successfully reach a settlement with the uninsured driver to cover the damages in excess of what your insurance company will cover. Even after you reach a settlement with the uninsured at-fault driver, you will need legal assistance to actually collect the money due to you. You may move to have the uninsured driver’s license and vehicle registration suspended until the negotiated settlement is paid up. Zarzaur Law can help you get the legal power you need to effect collection through processes like garnishing their wages or bank account, seizing personal property, or suspension of license and registration.

There are different reasons why drivers are uninsured or underinsured. They could either forget to keep up with their payments or may not be financially capable of paying their insurance premiums. A person who is unable to keep up with their car insurance payments is unlikely to have a huge resource base from which to pay for your damages. This can be challenging a situation to be in, but your lawyer will know best how to handle it.

4. Can I get a rental car and does the at-fault drive have to pay for it?

YES – you can get a rental car. NO – the at-fault driver’s insurance company is not obligated to pay for the rental car. While this may not seem to make sense, the at-fault driver’s insurance is not legally required to give you a rental car. The only “rental car coverage” is one that would be on your own car insurance policy. It is an optional coverage that is not often purchased, but if you have paid for it, you should use it.

The at-fault driver’s car insurance ultimately has to pay for your property damage called “loss of use,” for each day that you are not able to use your vehicle. So many times the at-fault driver’s car insurance will offer a rental car in lieu of having to pay you for “loss of use”. The at-fault insurance company also offers a rental car to sometimes keep a good rapport with you in hopes that they can convince you to not hire an injury lawyer and to settle your injury case for nothing.

5. When I go to the ER, what insurance information do I need to give them?

According to Florida Car Wreck Law, the only insurance that can pay for the first $10,000 in medical expenses is YOUR OWN PIP COVERAGE. The hospital should ask you for the name of YOUR car insurance carrier and possibly a claim number. Many times you will not have a claim number, but as long as you give them the name and policy number, the hospital billing department can determine where to send the bill for payment.

The hospital may ask for your health insurance carrier as secondary coverage, and you certainly should not hesitate to give them this information as well. There is no need for the hospital to have the name of the at-fault driver’s insurance policy since it will not pay for anything until a personal injury lawyer, like Joe Zarzaur, requires them to.

5. Can I handle the “Car Part” of the claim without a lawyer?

Yes, and you should, BUT be very careful not to discuss your injury claim with the insurance company, since they are COMPLETELY SEPARATE CLAIMS. The injury claim and the car (also known as “property damage” claim), are distinct claims and are not even handled by the same adjuster. The at-fault driver’s insurance company will assign a property damage adjuster and an injury adjuster to the claim.

You can and should talk to the property damage adjuster since they are only involved in determining if the car is totaled or handling getting it fixed. Zarzaur Law, P.A., a personal injury law firm, rarely, if ever, gets involved in the property damage portion of the claim. The property damage claim is usually resolved within 10 to 14 days after the wreck. The value of a car is something that is not really negotiable and both you and the adjuster can access this information online. Kelly Blue Book or NADA will have tools you can use to assess the value of your car by make and model.

6. Should I give a statement about my injury to an adjuster without a lawyer?

NEVER GIVE A RECORDED STATEMENT TO AN ADJUSTER WITHOUT A LAWYER. This is the oldest trick in the book and standard practice for most insurance adjusters. They actually get bonuses based upon how many injury victims they get on record talking about their injuries. The insurance companies want you to speak with their adjusters who are trained to get you to say things on the recorded line that minimize your injuries and then later, once the injuries have been fully diagnosed and the adrenaline has worn off, use against you and your injury case.

Insurance adjusters may make you believe that not giving a statement about your injury it will slow the claim process down – this is NOT true.

The injury claim is 100% separate from the property damage claim. It is also very important to understand that insurance companies really want to deny the claim. If the insurance adjuster gets you on a recorded line and gets you to say something that appears different from what you told them when your purchased the policy, they can use that fact to deny coverage. It is recommended that you have a lawyer, like those at Zarzaur Law, P.A., on the phone with you before anything is recorded.

If you are asked to give a “recorded statement” so that they can get the claim started…..Refuse to give the recorded statement without a lawyer. If the insurance claims adjuster insists, tell them you will call a lawyer right away, since they are not giving you any other options.

7. Does it cost money to get advice from Zarzaur Law, P.A., even if I am uncertain about my injury?

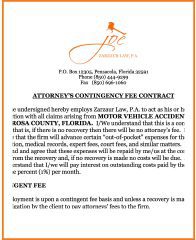

Click HERE to view full contract sample

No. All advice and counsel up to the point of recovery of money is FREE. The lawyers at Zarzaur Law offer free advice to clients and non-clients alike as part of our business practice, and it is customary in this field of law to provide this service. We only collect fees and costs if we actually make a monetary recovery for your injury case. Once we are retained as your personal injury firm and you sign our firm’s contingency fee contract, you then are agreeing to pay us, but ONLY IF WE WIN AND GET YOU MONEY. If we lose or do not get a monetary recovery, then you don’t owe us anything.

8. If I get discharged from the ER after a wreck and they say I am OK, does that mean I don’t need an injury lawyer?

NO. The emergency room is not there to diagnose every injury. The emergency room has one mission – to make sure that everyone seeking treatment there is not going to DIE or lose a limb within the next 24-48 hours. If you don’t fall into the class of severity (DEATH OR LIMB LOSS), you will be discharged from the ER with a general diagnosis and told to follow up with your primary doctor or a specialist.

Visiting the ER is just the very start of your injury case. Most of Zarzaur Law’s clients that end up with verdicts and settlements well into the six figures, left the ER with the same or similar paperwork noting “cervical strain,” “lumbar strain,” or “Whiplash injury”. The reason the ER is not in the business of providing a full diagnosis for every patient is that doing so would prevent them from accomplishing their main mission of preventing immediate death or loss of limb. Being discharged from the ER only means that the doctor felt that you were not going to die or lose a limb in the next 24-48 hours. The ER diagnosis is very basic and thus you should not read into your discharge from the ER as meaning anything about the full extent of your car wreck injury.

9. The ER told me to follow up with my primary doctor. When I called their office, they told me they don’t accept car wreck-related injuries. I have been a patient there for many years and don’t understand why they won’t see me.

Unfortunately, this issue is extremely common. There are two basic reasons:

1.How Does PIP Work If You Have Another Car Accident in Florida? PIP insurance is the only insurance that can pay for any of the first $10,000 in medical treatment. Health insurance claims will be denied until the $10,000 in PIP has been fully used and the health insurance carrier receives proof that the PIP benefits have been exhausted. Most healthcare facilities are not set up to bill automobile insurance, since their systems are set up to bill health insurance, and for this reason, many physician offices prefer to steer clear of automobile cases.

2. Many doctor’s offices do not like to deal with litigation cases due to the time required to answer calls and respond to medical records requests from law offices, like Zarzaur Law, and in some cases, having to provide testimony about the patient’s treatment.

10. What else should I do to make sure that I protect all of my rights following a car wreck?

Zarzaur Law, P.A. promotes a list of tips for easy reference in the event you are involved in a wreck — CARWRECKCHECKLIST.COM. This resource contains 10 very important pieces of advice for those who are the victims of a careless driver. Click the carwreckchecklist.com link to be taken to this list.

Be confident you have a legal expert on your side.

No Cost, No Fee, Unless We Win

Zarzaur Law is a pure contingency fee law firm. There is NO FEE unless you win. If you don’t collect, we don’t either. Results matter, so make sure to check out our case results as well as our client reviews see what are clients have to say about our firm.

Additional Resources:

- What are the most common car accident injuries?

- Why Video Evidence is Important in Your Car Accident Injury Case.

- Who Pays For My Medical Bills After a Car Accident?

Contact our firm today to request a case review or call today at 855hirejoe for your FREE consultation.